Introduction

Technological advancements in the financial sector have historically been fueled by the pursuit of heightened efficiency, cost reduction, streamlined workflows, and adherence to regulatory mandates. However, recent years have witnessed a paradigm shift as the convergence of digital transformation and disruptive technologies has accelerated the pace of transformation within financial markets.

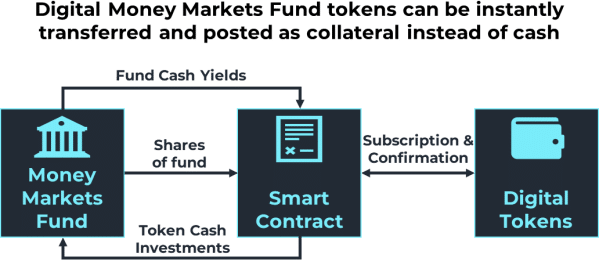

Blockchain and Distributed Ledger Technology (DLT) are poised to revolutionize multiple facets of business processes by enabling faster transactions, enhancing transparency, and driving operational efficiency. The successful completion of the first blockchain collateral settlement by JPM and Barclays in October 2023 is a testament to this transformation. This event marked a significant milestone in the use of tokenized Money Markets Fund shares for collateral exchange.

As financial markets evolve, digital technologies are fundamentally reshaping the utilization and management of collateral.

This piece will investigate how Blockchain, DLT and Instant Settlement could transform the world of Collateral Optimization.

How is the Landscape Evolving?

The Move Toward Accelerated Settlement

The pace of settlements will be accelerated starting May 2024 with the adoption of T+1 Settlements in the United States. This has prompted other jurisdictions such as the UK and EU to explore the potential benefits of faster settlement processes, which include reduced settlement risk and improved capital efficiency. However, transitioning to a T+1 settlement cycle is not without obvious challenges particularly around technology and operational dependencies. Facilitating faster settlements means implementing more efficient trade processing across the entire lifecycle, posing challenges related to error resolution and risk management, including in collateral management.

For instance, legacy T+2 cycles still apply to FX transactions, presenting substantial settlement risks that can be mitigated through the adoption of solutions for faster settlement. Blockchain and DLT hold the potential to facilitate T+1 or even real-time settlement by offering an efficient and transparent means of recording and settling transactions. A survey conducted by the Bank for International Settlements (BIS) found that nearly a third ($2.2 trillion) of deliverable FX turnover remained subject to settlement risk as of April 2022, which is up from $1.9 trillion in April 2019. This highlights the need for accelerated settlement capabilities which will significantly reduce this risk across the market.

The Rise of Digital Assets

Tokenization, the process of converting rights to a physical asset into a digital token on a blockchain, brings a slew of advantages to the securities world, such as reduced processing costs, lowered settlement risk, and broader access to markets via fractional ownership.

The transfer of tokenized assets necessitates a distributed ledger, which provides a real-time overview of asset locations. Central Bank Digital Currencies are poised to enable instant settlements of securities payments to support the transfer of tokenized securities. Custodians will play a pivotal role in connecting the new world of digital assets to the existing financial landscape and reconciling the movement of digital assets against their underlying physical assets.

What Does This Mean for Collateral Optimization?

Collateral Optimization is on the rise

The topic of collateral optimization has been pushed to the forefront in recent years, fueled by a confluence of regulatory reforms, market shifts, and transformative technological advancements.

Regulatory initiatives such as Uncleared Margin Rules (UMR), clearing mandates, and liquidity ratio requirements have introduced more stringent capital requirements and asset eligibility constraints. This highlighted the importance of global inventory management, as firms prioritized HQLA assets for liquidity and identified underutilized assets for margin requirements.

The recent surge in interest rates has significantly escalated funding costs, prompting a need to review long-standing allocation processes and the need to mobilize cost-efficient assets to drive opportunity P&L. Collateral optimization is now a strategic imperative for cost mitigation and alpha generation.

Technology plays a crucial role in enabling interchangeable assets across various products, time zones, and currencies. This cross-product perspective provides valuable insights into global financing costs, enabling trading desks to foresee market trends and strategically position liquidity. Conducting trades on an individual asset basis or managing transfer pricing across the organization requires robust real-time data analysis.

The latest developments in Blockchain, DLT and digital transformation will be key in enabling firms to implement enterprise-wide optimization strategies.

Optimizing in Real-Time

Collateral optimization in real-time involves the continuous, automated process of allocating and reallocating collateral as efficiently as possible to meet various financial obligations and regulatory requirements, while also aiming to achieve cost savings and efficient use of capital. This process is highly dynamic and requires sophisticated technology and analytics to manage effectively. With instant or near-

instant settlements, the reduction of settlement latency not only accelerates the timing of available positions, and can also potentially reduce the buffer on over- collateralization, thus allowing for more efficient use of capital.

Instant Settlement also enables the implementation of strategies that can proactively manage the optimal utilization of assets through rebalancing and substitution. Frequency of rebalancing activities can increase as a result of elimination of transaction/operational burden related to substitutions. This enables continuous bilateral collateral optimization engines, similar to the current Tri-Party setup.

The impact on collateral optimization is extensive, promising a revolutionary approach to inventory management and allocation.

Risk Management through Optimization

The potential benefits of collateral trading and optimization with DLT include fully streamlined Securities Financing Transactions (SFT) trading and collateral management, resulting in a substantial reduction in settlement and credit risk. The capability to instantaneously transfer assets empowers optimization engines to react more effectively to market shocks, reducing concentration and wrong-way risk. DLT’s transparency enables real-time tracking of digital assets and collateral transactions, providing a readily auditable history of collateral movements. This transparency enhances risk management and regulatory compliance. DLT and digital assets broaden the range of assets available for collateral optimization, encompassing tokenized real estate, securities, and commodities, thereby increasing diversification options and reducing concentration risk.

Whilst Blockchain and DLT will provide many of the aforementioned risk management benefits, there will also be a shift in risk. Banks will need to closely consider how large market moves and volatility spikes will impact their collateral optimization strategies, as swings will happen much more quickly with instantaneous settlement. Immediate settlement requires access to assets at all times, thus elevating liquidity risk. This is particularly relevant to the rehypothecation of assets, as instantaneous settlement and the lowering of substitution limits may lead to higher collateral turnover rates. These new and heightened risks will require significant ‘what if’ analysis to simulate the Bank’s capabilities to deal with these situations.

Reduced Funding Costs and Enhanced Capital Allocation

Tokenization has far-reaching benefits for collateral management, including the potential for digital collateral ledgers reflecting real-time collateral ownership, leading to improved balance sheet efficiency. This facilitates superior capital allocation, as recalled collateral can be promptly reused, sold, or lent out. The tokenization of collateral baskets offers the possibility of reduced funding costs, by replicating similar efficiencies found in the Tri-Party setup, as more precise and dynamic optimization of collateral is possible.

DLT simplifies and expedites collateral optimization through the automation of collateral-related processes, reducing operational costs.

The introduction of DLT can negate settlement fees and restrictions on substitutions. DLT facilitates the creation of collateral pools, where multiple participants contribute digital assets to a common pool, automatically managed through smart contracts.

Tokenization and New Eligible Collateral

Smart contracts, powered by DLT, are self-executing contracts with the terms of the agreement between counterparties directly written into lines of code, automating the process of managing and adjusting collateral based on predefined rules and real- time data. This streamlines tasks such as collateral eligibility assessment, substitution, release, and even execute margin calls and collateral reallocation based on predefined conditions.

Optimization strategies will need to quickly adapt to new asset types and eligibility rules. For example, a key new collateral type will be tokenized money market funds, which are already being used as collateral between JPMC and Barclays. By tokenizing these funds, traditional money market assets can be fractionalized into digital tokens. Outside of money markets funds, tokenized real estate, commodities, and other debt instruments could also enhance accessibility and liquidity. Firms may

need to reconsider their strategic asset allocation to ensure that they have the right mix of liquid assets available for collateral purposes at all times.

How Can We Prepare for Digital Disruption?

Being prepared to harness new technology necessitates a robust framework. However, like any new technology, there are challenges to consider, such as scalability, standardization, and regulatory considerations.

Governments are establishing sandboxes to help banks future-proof their operations for DLT, such as The Digital Securities Sandbox in the UK. Participation in these sandboxes allows institutions to stay abreast of the latest technological developments within the industry.

Adaptability

The successful optimization of collateral requires a holistic approach that integrates strategic foresight with cutting-edge technologies. Trading and optimization strategies must be adaptable, capable of assessing the cost of various allocation scenarios and promptly calculating both immediate and long-term costs. Versatile collateral optimization strategies are essential to account for new products and intraday risk management mechanisms. Technology architecture must seamlessly integrate with new systems and vendor technologies to keep pace with the rate of disruption. Existing frameworks will also need to be uplifted to support new legal terms associated with digital assets, so it is important for firms to have a digitized golden source of legal data to quickly onboard new documents. Other functions such as Credit Risk will also need new policies to determine how tokenized assets should be treated, so firms should look to assess the agility of their credit systems in supporting these.

Real-Time Processing

To align with the instantaneous nature of DLT, workflows should feature standardized processes with automated triggers to detect real-time inventory changes, price fluctuations, exposure shifts, and more. Real-time analytics will prove

indispensable in mitigating risks associated with immediate trade settlement. Real time collateral management is also dependent on all participants having access to real time market data and common frameworks for intra-day pricing, as market practice is currently for bilateral margin calls to be valued based on EOD snapshots.

Partnerships

Given the implications of DLT and digital assets, market-wide participation is imperative. Firms must engage in an open dialogue with key industry players to address secure custody solutions for digital collateral and bolster cybersecurity measures to safeguard digital assets from emerging threats.

Conclusion

Digital assets and DLT are reshaping collateral optimization in the financial industry, offering increased efficiency, transparency, and diversification options. As the financial sector adapts to the digital age, these innovations redefine how collateral is managed, optimized, and utilized.

While challenges remain, the potential benefits of DLT and digital assets in collateral optimization are substantial. As regulatory frameworks and infrastructure continue to mature, we anticipate greater integration of these technologies into the financial ecosystem, ushering in a more efficient and risk-aware financial landscape.

ActiveViam contributor:

Victoria Chan is a Senior Business Development Analyst at ActiveViam’s New York headquarters. She spent the first half of her 20-year financial services career in leading buy and sell-side capital markets firms focusing on the clearing and collateral management domain and associated technology products. She has subsequently worked in the fintech realm leveraging her deep knowledge and experience to bring insights into client requirements and the software solutions she designs. Vicky holds a dual bachelor’s degree in financial economics and psychology from Binghamton University.

Tonic Contributors:

Steven Czarnota is a Senior Consultant with extensive experience in leading transformation streams across the post-trade lifecycle. He has recently focused on defining and benchmarking collateral management operating models across Sell Side Banks and Large Custodians.

Philip Forkan is Tonic’s Collateral Ninja, formally known as our Head of Collateral Practice. Philip is a highly experienced Senior Consultant and Collateral SME, with over 25 – years in leadership roles across OTC Clearing, Margin and Collateral. Philip has experienced first-hand all major collateral trends in that time, such as increasing collateral regulatory and business maturity, alongside an array of high-profile market events. Philip also has a track record of successful transformation delivery across Collateral and Clearing functions both at investment banks and global consultancies including RBS, Citi and Sapient.