Why Atoti is different

Atoti is a relational, transactional, columnar, in-memory database coupled with a modern, multidimensional OLAP aggregation engine, allowing for real-time, self-service analysis on fast-moving data and direct queries on cloud databases. Atoti is the fastest data analytics software made for financial services organizations.

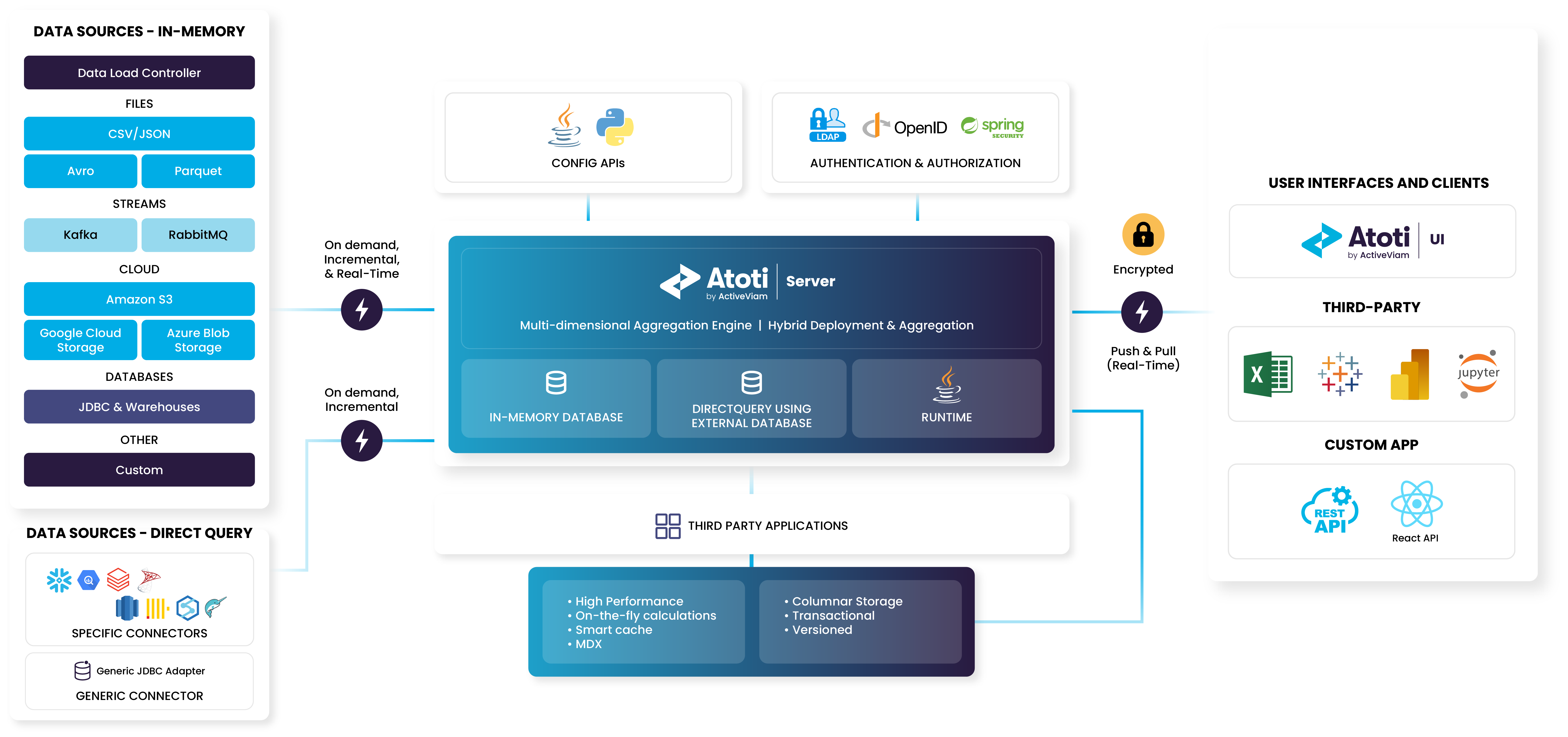

The Atoti platform

Perfect for critical decisions when traditional BI tools are too slow and IT delays are not an option

The only platform dedicated to financial institutions that combines real-time analytics and data management at scale.

AI-Powered Evolution: Enhancing Atoti for Smarter Data Analytics

Atoti, our advanced data analytics platform, is about to get even more powerful with the integration of artificial intelligence. We are dedicated to leveraging AI to enhance the capabilities of Atoti, making it smarter, faster, and more intuitive than ever before. Here’s a glimpse into how AI will revolutionize Atoti and elevate your data analytics experience.

Self-Optimizing Query Engine

The Atoti query engine learns from user interactions to optimize itself continuously. By employing machine learning algorithms such as hierarchical agglomerative clustering, Atoti classifies runtime queries and recommends the best configurations for aggregate caches, partitioning, and other tuning parameters. This self-optimizing capability enhances performance and ensures faster, more efficient data retrieval.

AI-Powered Assistance for Developers

Developers benefit from an intelligent assistant when creating Atoti models. This AI-driven assistant not only explains data modeling APIs but also generates the corresponding Python code based on the developer’s requirements. This feature significantly streamlines the development process, allowing for more efficient and accurate model creation.

AI-Driven KPI Explanations

Understanding the reasons behind changes in KPIs can be challenging. Atoti AI automatically explains variations in measures, whether they occur between different dates or regions. Using marginal calculations within the underlying cube, Atoti AI highlights the cube members contributing most significantly to these changes. This feature provides analysts with immediate insights, streamlining the investigation process.

Natural Language Dashboard Interaction

Navigating complex Atoti dashboards can be daunting, especially for occasional users. With AI, users build and interact with dashboards using natural language. This capability simplifies the user experience, removing barriers to entry and allowing users to leverage Atoti’s full potential without a steep learning curve.

Automated Analysis and Highlighting

Atoti uses generative AI to provide an initial analysis of dashboard data, highlighting critical points of attention. This "What should I look at today?" experience saves analysts significant time, visually accentuating important aspects and offering brief explanations to clarify their significance.

Enhanced Market Risk Scenario Generation

To better assess potential extreme market outcomes, Atoti uses Generative Adversarial Networks (GANs) to generate additional stress scenarios. This enhances VaR calculations and other risk metrics by incorporating a broader range of potential market conditions. This feature provides a more comprehensive risk assessment framework.

Code Upgrade Assist

When customers move to a new version of our business solutions, such as Atoti FRTB or Atoti Market Risk, our Code Upgrade Assist tool automatically upgrades up to 80% of the existing code. This significantly reduces the manual effort required by developers, allowing them to focus on reviewing and finalizing the upgrade efficiently.